Source: Aurora Energy Research

The national grid operator Trena is running capacity market auctions, with some contracts being awarded to battery projects.

The frequency response market has only been open to thermal generators in the past, but some pilot projects are being developed to open the service to batteries.

The Regulatory Authority for Energy, Networks and the Environment (Autorità di Regolazione per Energia Reti e Ambiente or ARERA) approved new criteria and conditions for large-scale energy storage capacity on 6 June 2023, which will allow Trena to run large-scale energy storage auctions

A consultation is running to get industry feedback on the design of the auction system, and the first auctions are expected for later this year or early next year.

A separate auction mechanism is being developed for long-duration energy storage (LDES) projects with a duration of 6 hours or more. It is expected that the contracts will be awarded for the entire operating life of the assets.

In return, participants must offer projects that can time-shift load and provide ancillary services.

What are Italy’s targets regarding energy storage?

Italy has a national energy plan (PNIEC) and targets a renewable share of 55% by 2030 in the electricity sector.

Based on this target, Terna expects that 15GW of total energy storage will be needed by 2030, of which 9GW needs to be LDES with a duration of at least 8 hours.

What can BESS bring to the table in Italy?

Close to 50% of electricity generated comes from imported natural gas. The build-out of renewable energy generators can reduce this dependency on imports. However, it will lead to grid constraints and a higher price volatility in the intraday markets.

And this where energy storage plants can help with the energy transition:

They can help stabilise the grid by absorbing excess electricity production during peak production times and releasing it back onto the grid when the demand picks up in the morning and evening.

There is less need to build new interconnections between the different price regions. Batteries can store electricity until it can be sent to another region.

Intraday price differences offer BESS operators the chance for arbitrage (buying electricity when it is cheap and selling it for a higher price later on).

Will Italy become the next UK for BESS?

The first large-scale projects have been granted planning permissions, and many investors are rushing into the market in a land grab.

In a PV Magazine interview, Milan-based management consultancy MBS Consulting estimated that trading in the spot market could cover 60% to 65% of the project capital expenditure (CapEx). The remaining 35% to 40% of revenue would need to come from ancillary services.

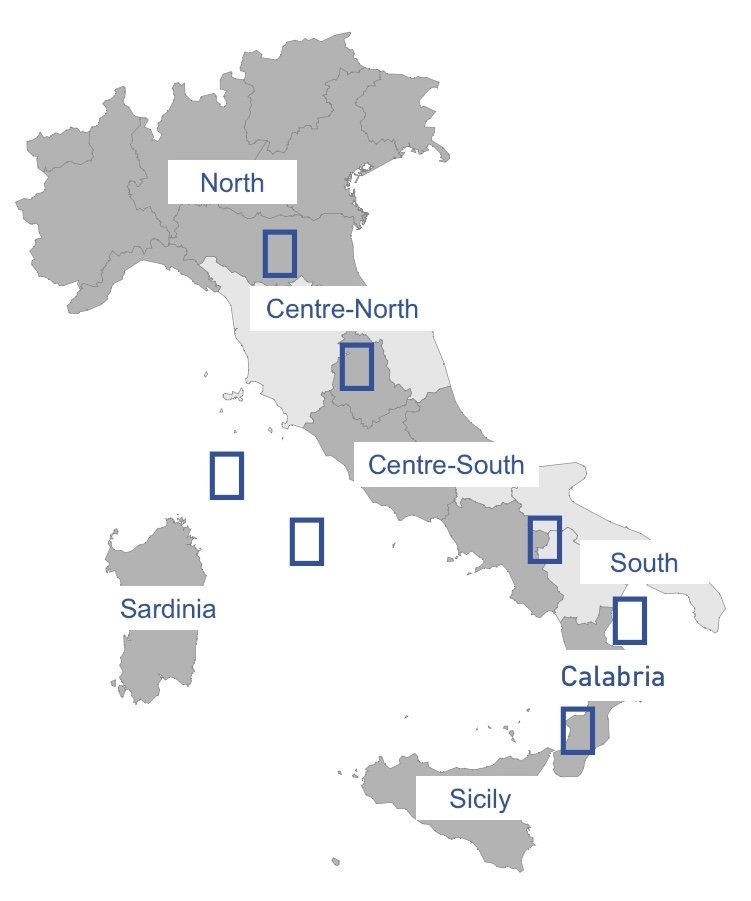

Italy’s different price zones and their limited interconnectivity will shape the Italian need for energy storage.

The two island markets (Sicily and Sardinia) favour a large-scale deployment of energy storage, as electricity cannot easily be exported to or imported from the mainland.

The large-scale deployment of solar energy plants in the country’s south will lead to excess generation during the daytime, requiring energy storage to shift the production to the evening peak demand.

These constraints will increase the need for a growing capacity market in these regions, opening up higher revenue opportunities for investors and making Italy an attractive market to be in.

Closing thoughts

Italy has a considerable potential and a significant need for energy storage. But picking the right location is crucial, with the south and the island markets offering more favourable market conditions than the country’s north.

Investors that enter the market will have an advantage over latecomers. As we can see in the UK market, more and more projects compete for the same ancillary service contracts, driving down prices. The earlier your project is ready, the fewer competitors you have.